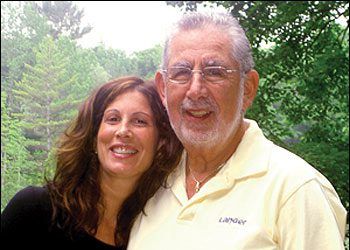

Ron Manganiello has been described as “the godfather of modern American O&P” and yet, Italian lineage notwithstanding, it was far from clear that this boy from Brooklyn, New York, would end up having such an effect on the O&P profession. This grand title was pronounced by Hans Georg Nader, president and CEO of Ottobock, Duderstadt, Germany, who recognized that Manganiello was the first financial investor to enter O&P – an industry that has had a long tradition of being closely held by families and insiders.

Brooklyn Born

Manganiello, the son of immigrants, grew up under the elevated train in the Borough Park neighborhood of Brooklyn in what was then an ethnically mixed blue collar neighborhood. As a boy, an only child, he shared a bedroom with his grandparents, and the family lived in an apartment building owned by his aunt, with plenty of cousins and other family members nearby. His father, an aspiring musician, spent his career working for the appliance manufacturer Hamilton Beach. Manganiello’s parents sacrificed to provide him a solid education, sending him to Catholic schools. After high school, he attended Long Island University and graduated with a degree in psychology and a minor in political science. Initially he had an interest in pursuing psychology but became frustrated with the profession after a yearlong internship at Pilgrim State Psychiatric Facility, Long Island, New York.

Manganiello, second from left, and Ivan Sabel, center, on the New York Stock Exchange floor during the first trade of Hanger stocks as a public company, November 1991. Photographs courtesy of Ron Manganiello.

Wall Street

It was 1975, and a friend suggested working on Wall Street. Manganiello, then in his mid-20s, interviewed and tested for a position at Merrill Lynch. He completed six months of training but moved to Lehman Brothers, where he says he was advised to “dress properly and learn.” He spent four years at Lehman and became a successful stockbroker working with high net worth clients. In 1980, he moved to the corporate services division of Drexel Burnham Lambert, where he entered the world of investment banking. His job there was to help buy and sell businesses. Fully engaged with a heavy workload, Manganiello still made time to attend classes at the Wharton School of the University of Pennsylvania, where he received a certificate in mergers and acquisitions.

Then, by chance, in 1985 Manganiello was introduced to Larry Gallo, CPA, who was looking to solve a problem. Gallo’s mother was a shareholder in an obscure old-line family business – the original J.E. Hanger. Although the 49 nonparticipating family shareholders were satisfied with the annual dividends it yielded for them, it was an illiquid asset, and Gallo wanted to know if the stock or the company could be sold. So Manganiello agreed to meet with the CEO, Joe Cestaro, CPO. While Cestaro was only a minor shareholder, his job was to run the company and “manage the factions of in-laws and out-laws.” At that time, J.E. Hanger had 11 facilities with about $7 million in annual sales and close to $2 million in earnings. The company was doing well, but the families wanted liquidity.

Manganiello saw an opportunity. He went to work looking for ways to finance a buyout, except this time he was going to be the principal. He took his life savings, and along with a couple partners and some bank financing, he bought the company outright for $11 million. It took a year to coordinate the deal and manage disparate family requests, but in 1986, Manganiello was in business for himself.

O&P Consolidation

He was an O&P outsider with a business background entering an industry characterized by family-run operations. He got to work getting to know the intricacies of the business, visiting the branches, and meeting the staff. The company was well run, and he knew it. Manganiello humorously recalls one lesson that has stuck with him. Early in his tenure, he met the owner of Accurate Knitting Mills, a manufacturer of prosthetic socks. Together they decided to save costs by reducing the range of prosthetic socks available to practitioners. The pushback was immediate: the practitioners were angry that they were not consulted on a patient care decision. Since then, it has been his philosophy to let the O&P practitioners run their practices while he manages the business. His role within J.E. Hanger was well defined: pay the bills on time and ensure the company remained well funded and continued to grow.

Manganiello’s personal goals were also clear: pay off the debt of the acquisition, streamline the operation, modernize the company by introducing computers, and earn a good living. At the time he was settled in New Canaan, Connecticut, but travelled regularly to Washington DC, where J.E. Hanger was then headquartered. One opportunity for growth that Manganiello identified was in materials and supplies. J.E. Hanger already owned Washington Prosthetic Supplies, a distribution business. Soon it acquired National Prosthetic Supplies, a New York-based distributor. Eventually those regional units merged with the distribution arm of Southern Hanger to form Southern Prosthetic Supply (SPS).

In 1988, Manganiello met Ivan “Van” Sabel, CPO, through a mutual friend. Sabel had the legacy of being the third generation in O&P related-professions and understood patient care. He owned Maryland-based Capital Orthopedics and had recently bought Greiner & Saur Orthopedic Appliances, a multi-facility practice in the Philadelphia area. Sabel and his co-investors were actively engaged in the strategic purchase of O&P facilities to form a larger company. Manganiello and Sabel found they were compatible business partners and joined forces. In February 1989, financed through Manganiello’s Wall Street connections, they merged their businesses and formed Hanger Orthopedic Group, which had sales close to $10 million. Manganiello recalls that, at the merger closing, Sabel quipped, “Someday we are going to be a $50 million business,” and everyone in the room laughed.

Rapid Growth

This was the beginning of a whirlwind of activity; over the next nine years the company bought more than 40 practices. The philosophy was to acquire well-established businesses in various markets, bring them into the Hanger family, pass along operational savings, and allow them to operate under their original names within their respective communities, keeping them unique. Manganiello remained chairman and CEO. Travelling three weeks per month, he raised capital and coordinated acquisitions. Sabel, as president and COO, oversaw the clinical side of the business, and through his extensive contacts was able to reach owners and discuss the possibility of buyouts. Tom Whelan, CAO, joined the team and played a critical role as the transition manager. The company was growing quickly, but the debt was also piling up. In May 1991, the leadership made the decision to go public, and the company was listed on NASDAQ, raising $13.75 million. One year later, there was a second market offering that raised an additional $14.8 million, and a final equity investor provided another $4 million. After that, additional capital for growth was provided by bank credit line facilities.

From left, Manganiello and Sabel in November 1993 with the NASBIC Portfolio Company of the Year Award.

Manganiello attributes Hanger’s success in the 1990s to several things. First, capital was available. Unlike today, it was easier for small companies to borrow from banks and raise funds by going public. Second, it was still the early stage of consolidation within O&P. Finally, the synergy brought about by assembling the right team made a lot of things possible.

In 1997, the Hanger board of directors wanted Manganiello to move to Bethesda, Maryland, to be closer to the company headquarters. However, given family circumstances and the hectic travel schedule he had endured, he decided it was time to slow down and do something different. In 11 years, the Hanger management team had helped build the company to $350 million in revenue. He left the company on good terms and has remained close friends with Sabel. He returned to Connecticut to become a more active partner in New Canaan Capital, his private equity investment company.

New Venture

The following year, Manganiello was approached by a local O&P practitioner who wanted help setting up a small private practice. Manganiello says he thought nothing of it and provided funds for a single-facility business, New England Orthotic & Prosthetic Systems (NEOPS). As a result of this move, the Hanger board sued NEOPS. Manganiello defended against the action and won, but it was costly, so to recoup the money, he decided to grow NEOPS. Soon thereafter, Whelan joined as the COO and became an important part of the new business’ success, says Manganiello.

This phase of Manganiello’s career would be different. He wanted a more regional business where, in his own words, he “could drive to any of the locations by lunchtime.” NEOPS did acquire a few existing facilities, but rather than buying businesses, it built the company around practitioners. This was a different business model than what he had employed at Hanger: the branch manager became a 20 percent partner in the operation. Over the next 15 years, NEOPS grew to 32 branches and close to $30 million in sales. Manganiello says he always believed that working closely with suppliers and paying them on time was another ingredient for success.

Coming full circle, Mac Hanger, CP, a great-great grandson of the original James Edward Hanger and the last of his direct descendants working in O&P, joined NEOPS to become a manager in the Hartford, Connecticut, region. In 2012, Summer Street Capital, a private equity firm, bought 75 percent of NEOPS, providing the owners and branch managers with a sizable payout. In retrospect, Manganiello feels the NEOPS model worked perfectly with no turnover of manager partners. He remained CEO for three more years until Dave Mahler, CPO, one of the original NEOPS branch managers, took over in 2015. From 2012 to 2015, Manganiello also served as a director of the American Orthotic & Prosthetic Association, and remains on the NEOPS board with a minority stake.

Over the span of four decades, Manganiello has been involved in significant changes in O&P: initial consolidation, the introduction of Wall Street, and more recently, private capital investors. Looking to the future, he sees many headwinds facing O&P as the country overhauls the healthcare system. He says it is more difficult than ever to be in private practice-dealing with non-patient-care issues including regulations, billing, marketing, and information technology. His advice to independent practice owners and to the industry is to join together. As a smaller ancillary provider of healthcare services, he feels strongly that the entire profession needs to unify and combine forces with other groups such as durable medical equipment, physical therapy, or respiratory therapy. “This is the way that our voice will be heard and the real value we provide can be recognized in the ongoing national debate,” he says.

After 30 years in O&P, Manganiello took a long-deserved break this summer sailing along the New England coast, but he is far from ready to retire. He says he has recently been conversing with manufacturers and associations looking to what may come next. After all, a godfather never really retires.

Séamus Kennedy, BEng (Mech), CPed, is president and co-owner of Hersco Ortho Labs, New York. He can be contacted via e-mail at seamus@hersco.com or by visiting www.hersco.com